Two Days at Transform Finance

I spent two days at the Transform Finance Institute in New York, at the CUNY School for Labor and Urban Studies (which you should totally check out). My goal in attending this training was to learn more about finance and investments and understand how these tools might work for social justice issues.

As a manager of non-extractive loans that get deployed to democratic businesses in Detroit, I was excited at the idea of being in a room full of people who were also thinking about ways fiance could work for the majority, rather than against us. Detroit Community Wealth Fund sits right in the intersection of finance and social justice- we give non-extractive loans to support good, locally jobs, and we ensure that communities are not harmed while working with us and receiving loans from us. DCWF was also created as a member of the Seed Commons Community Wealth Cooperative- a national lending institution that actively works to divert capital from extractive places and re-invest in communities, and in democratically owned businesses. In short, we think about investments and capital, and how to influence reinvestment alot.

There’s me in the jean jacket!

What is Transform Finance?

Transform Finance was co-founded by Morgan Simon and Andrea Armeni and works with a network of asset owners and other finance practitioners exploring how to deploy capital for social change in accordance with the principles of transformative finance. With a commitment of over $2 billion in aligned capital, the network is an opportunity for investors to workshop and compare cutting edge impact practices, receive deal analyses, and engage with communities (this is all from their website, by the way).

The Transform Finance Institute was created to help the financial, non-profit, and the social justice sectors to understand how each group can work to benefit each other- and how we might be able to move capital to work for us, rather than against us.

Transform Finance also works with community-based organizations by helping them use capital to advance their missions. They connect investors to projects that serve marginalized communities, support place-based investing initiatives through trainings, and educate grassroots leaders on capital strategies for social change through the flagship Institute for Social Justice Leaders.

The Transform Finance Principles

At the beginning of the training, we set up the stage a bit- we discussed our collective and individual definitions of social justice, and of finance. The the TF team shared with the group, about 50 of us, the principles behind this work for them.

#1 Meaningfully engage communities in the design, governance, and ownership of the investment process and enterprises.

#2 Ensure that those running institutions are structuring transactions, add more value than they extract.

#3 Balance risk and returns between investors, entrepreneurs, communities, and other stakeholders so that everyone benefits.

Tools, Tools, Tools

Shareholder Education and Advocacy - We need to work to educate shareholders about where their investments are going, what they are being used for. This way we can pressure companies to change their practices if shareholders threaten to divest from the company. This is very simply put, but there is more we can do as organizers to work with shareholders and acknowledge them as decision makers, and people of power.

Push for socially responsible investing, and for mission related investing- Increasingly, foundations, investors, and investment advisors are looking to invest in more socially and environmentally responsible places. We need to push this more! And work to make these opportunities more open, and find ways to better support business in projects in receiving these types of investments.

Less extractive lending- We can lend to businesses and projects with concessionary loans, which mean below the market rate of interest, and also with non-extractive loans, which means we leave the project or business better than we found them, no matter what.

Invest in children! Creating childhood savings and investment accounts can jumpstart a child’s wealth- they can get $5,000 by the time they are 18 just by investing $100 when they enter kindergarten. Imagine what our country would be like if every child started out with +$100, or +$5,000.

Support entrepreneurship without return. Right now, there is more money committed to supporting socially and environmentally responsible projects than there are projects ready to receive this capital. So we need to better prepare businesses to start and scale. For me, I think the most important thing we can do if we want to move capital into more democratic, more community controlled and benefiting hands, is to prepare that community and those workers. And I think it should be free to the entrepreneurs.

Important Takeaways, Questions, and Thoughts

MORE COMMUNITY VOICE! Now that I really think about it, I seriously cannot believe that community foundations do not have direct community voice on which projects they fund, and which non-profits they support. I can’t believe that CDFIs (Community Delveopment Financial Institute) don’t have crystal clear pathways for incorporating community voice into their investments. We need foundations and CDFIS to be more transparent in their decision making processes, and we need to have more community voice! More community representation at the decision making table. Period.

Capital Movement work must be done in tandem with on the ground social justice work. Organizing capital campaigns, divestment campaigns, or working to influence capital must be done in collaboration with grassroots organizing work. I learned that in the SEIU (Service Employees International Union) the public campaigns to fight for better wages or working conditions, there were also behind the scenes work trying to influence other stakeholders. As social justice organizers, often times our relationship with money is complicated- we don’t get paid enough, our work is often unpaid and volunteered, and in the non-profit complex, we are often having to ask for money to fund our work. In this case, we should also be working to make capital work for what we care about- work to identify who else, what other stakeholders have power in the situation, and see how working to influence capital might benefit us.

Do we really know where foundations invest? During the course of the training, I realized, I might know where a foundation gives, and what giving priorities a foundation has, but do we really know how they make all that money? As if it we didn’t have enough to do already, it is critical that we know where and how foundations, institutions, and endowments are investing. What if a foundation is investing in industries that are directly in opposition to the work we are doing? Grant making to a environmental non-profit, while investing in Exxon? What about Prisons?

Pensions Funds belong to the people. State Pension Funds hold billions of dollars in investments that belong to the people who will soon, or are, using that money to retire. This money is invested, and it grows. If you are a public worker, a teacher, a city worker, do you know where that money is invested? What if that money could be invested into your local community? Pension recipients should know where their money is being invested, and have a say in where that money is invested, For example, pension funds often invest in assets that are easily liquidated, so that people can receive payouts when needed. This means that much of the pension funds are being invested into fossil fuels. Do you want to invest in fossil fuels right now? Well, if you don’t we need to organize!

Re-framing risk, and lessen the impact on the borrower. Undeserved and underestimated communities by definition have less to lose, so we can’t afford to put low-income entrepreneurs at further risk. We need to re-frame what risk means when we are considering making investments into the community. What are we risking if we don’t invest? And, we need to understand the cost of investing- and be dedicated to lessening the risk to the borrower by supporting the borrower in growing and developing their project.

My own unanswered questions

The training covered a spectrum of ways finance might be able to work for social justice, racial justice, and economic justice initiatives. What we took away after the training was a basic, very basic, understanding of how finance and capital function, how who has capital, who controls capital, and who receives capital.

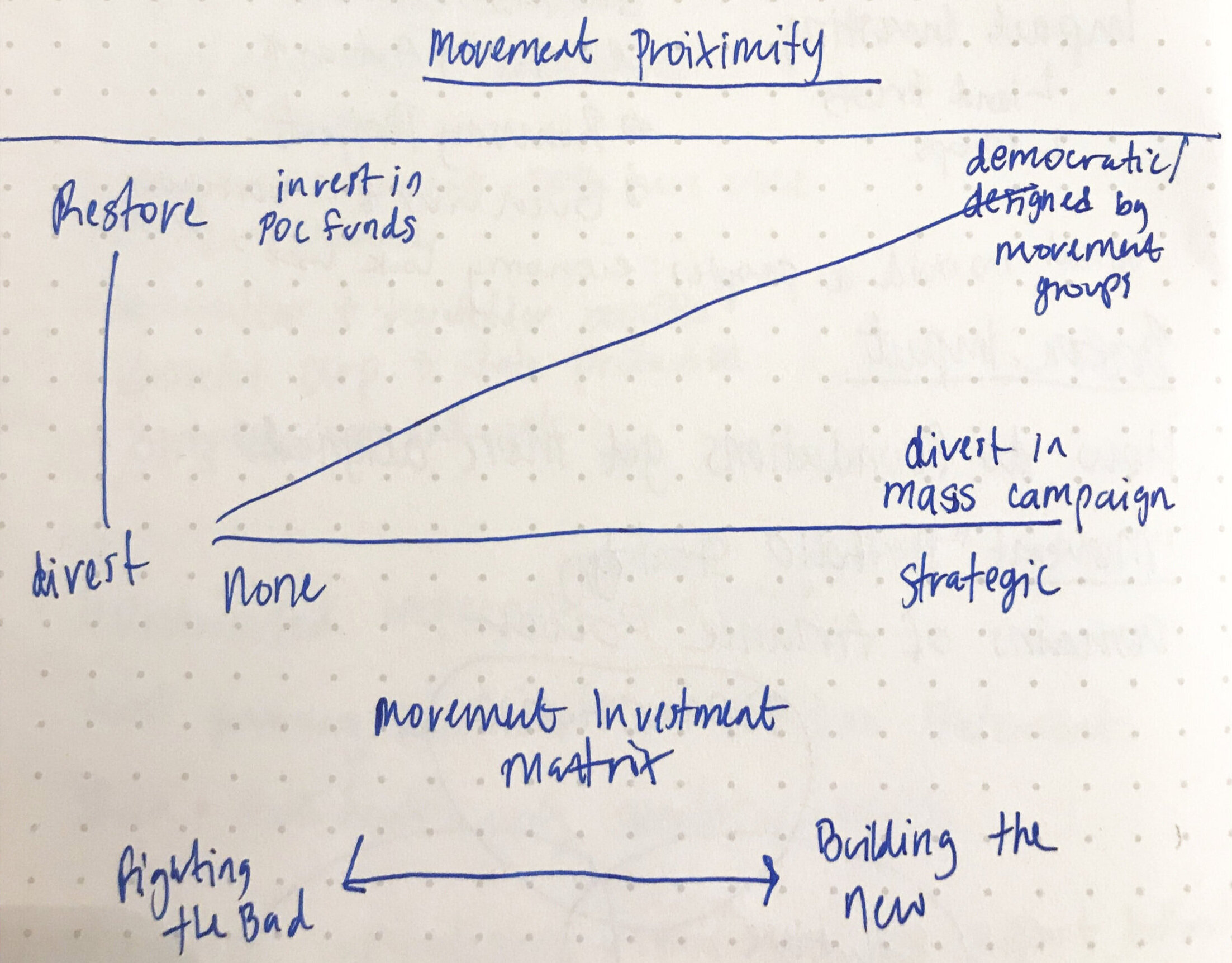

We talked a lot about strategies- tools for restoring capital, such as investing in “People Of Color focused funds”, and also tools for divesting, such as education and influencing shareholders.

I often felt like there were still some major elephants in the room. Sometimes we pointed them out. Let’s be real though, whenever you are talking about “solutions” to social and racial justice issues, there are always elephants in the room.

First of all, many of us know what structural changes are necessary in order to have a more just and equitable society. We can look to other thought leaders for these ideas and changes too. We also know what the world of finance responds to- to low risk, high returns, and big impact. Small shifts in local economies often does not add up enough to merit a foundation, or an investor putting time and resources into changes of this size.

I had a great conversation with a fellow participant, Alfa. (Okay, Alfa is amazing.) She explained to me this great hypothetical, which was both eye opening, and made me want to just curl up. I was talking to her about leveraging institutions to be able to contact with cooperatives- essentially as a way to build community wealth by creating long-term partnerships with big spenders, like universities and hospitals. Alfa said, even if a hospital commits $5 Million in local spending, even if that went to local jobs, it really would only support 25-30 local jobs. (The math is something like this: if that $5 million goes to a company, after their costs, which is, let’s estimate about 50% of their revenue, they make $2.5 million. Then if you factor in their fixed costs, at about, let’s say 25% of their revenue, we are left with about $1.25 Million- which, if we have everyone a salary around $50,000, equals about 25 jobs.) Even if my math is a bit off, her point was that the amount of time and money it would take to develop a cooperative-owned, locally benefiting company, and convince the institution to even contract with the, instead of their current, likely cheaper caterer, would take years of planning and implimentation. It’s not that it can’t be done, its that in our current framing, we chose to invest time and money into strategies with more impact.

Now, if we figured out how to take Michigan’s $5 Billion pension (which by the way is notoriously underfunded) and do something with that- maybe that would be big enough to get people behind. Even if we just tried to move Detroit’s pension fund, it is $1.7 Billion!

Some Inspiring Work you Should Check Out

NYC KIDS RISE - Building a city-wide child savings program.

SCHUMACHER CENTER FOR NEW ECONOMICS - Working on new economic work in western mass.

RISING TIDE CAPITAL - Supporting entrepreneurs in New Jersey City.

PRIVATE EQUITY STAKEHOLDER PROJECT - Working to identify, engage, and connect stakeholders affected by private equity.

What does this work mean for Detroit?

A few things, I think, off the bat. First, I strongly feel that we need more space for conversations and learning about finance, and the way finance works in Detroit. We need to have the conversation, and do some old-fashioned pen-to-paper power mapping in Detroit, and in our region. Who are the foundations? Who are the investors? Who are the influencers? What are efforts in Detroit we want to push capital to, or pull capital away from? What do we need to divest from in our community? What do we want capital to go towards? We have many foundations in Detroit, who is influencing them, and how can we get more community voice into the decision making process?

Detroit is a neoliberal city. Privatization and corporate power seem to rule supreme, and that was intentional. How do we create processes to return wealth back to the community? To build worker owned and cooperatives businesses? To influence our city’s investments, our city workers’ pensions in the community, rather than in extractive places they are currently?

If you want to talk more, know more, or help bring a Transform Finance Institute to Detroit- get in touch!

- Margo | margodalal@gmail.com | detroitcommunitywealth@gmail.com